LGB’s Market Commentary for Q1 2024

We have commented in the past about the futility of forecasting and the importance of understanding where we are – in the words of the great investment guru, Fatboy Slim – right here, right now. Markets are a reflection of current sentiment not a predictor of the future. The difference between the wisdom of the hive mind and the madness of crowds is only one of perspective.

At the beginning of the year there was an overwhelming consensus that interest rates were on an inexorable downtrend across the G7 (with the possible exception of Japan). The Fed was anticipated to be about to embark on seven rounds of cuts. Conflict in the Middle East and tension around Taiwan seemed to be an acceptable risk.

Since then the interest rate outlook has changed significantly, particularly in the USA. The Middle East has got rather more worrying, and the position of the Ukraine worse, bringing a direct threat to the NATO Baltic countries that little bit closer, and there has been no improvement around Taiwan or in the South China Sea. At the time of writing an Israeli strike on Iran still seems to be a possibility with unpredictable consequences.

The Current Situation – starting with the biggest market

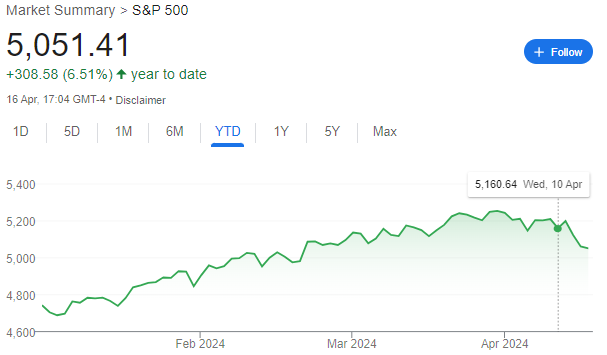

So, where are we now? Equity markets, which had been on something of a tear, led by the so-called Magnificent Seven tech stocks in the USA since October, seem to have hit a brick wall since around the 20th March.

This was despite a Fed meeting after which Jay Powell (US Federal Reserve chair) said that there was no change in attitude towards rate cuts. As the FT suggested, this seems to have represented peak optimism that the US could grow strongly with full employment and simultaneously see rate cuts and disinflation. The growth and with it high employment seem firmly embedded, and correspondingly significant rate cuts appear less likely, as evidenced by the higher level of options market-implied rates forecast. In addition, quite a few prominent analysts are now predicting Fed rate hikes this year.

Since the Fed meeting we have also seen a sharp increase in tension in the Middle East, oil prices nudged up (Brent is up about 17% ytd, currently around $90, and the IEA which was forecasting a surplus is now projecting a deficit), Tesla reporting declining unit sales and subsequently job cuts, and still overall strong US growth and employment numbers.

US Bonds

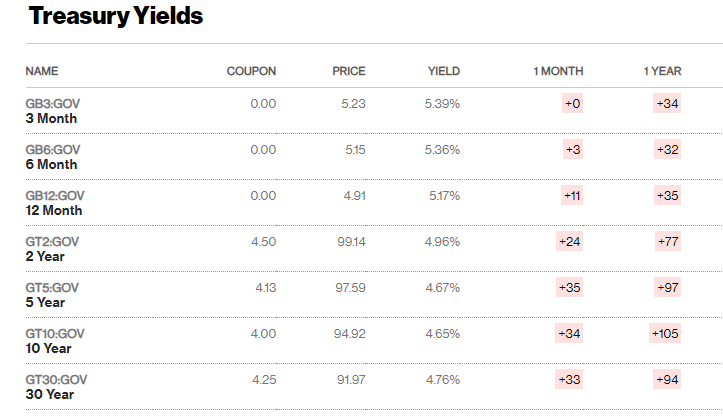

10-year US Treasuries are now yielding almost 4.7% vs just under 4% at the beginning of the year (and two year are at almost 5%):

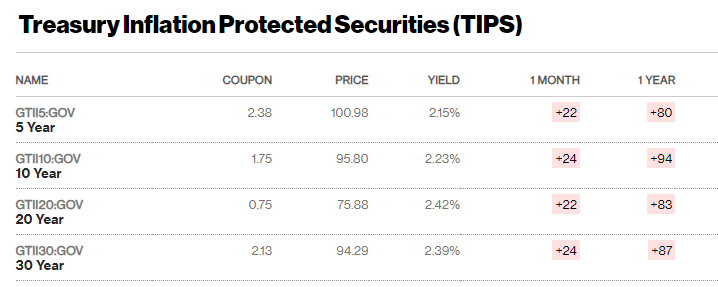

and implied inflation-adjusted yields have risen from around 1.5% to over 2%:

The US remains the standout economy, and with Tesla and Apple perhaps excepted, it has the standout tech companies, but the bond market is exacting a price for that. If you think that 4.7% nominal and somewhere around 2% real returns before tax are acceptable on a ten year view, and that the strength of the US economy will continue to strengthen the US dollar which is already towards the top of its range vs the Euro (with the exception of the spike after the outbreak of the Gaza conflict) since before the Global Financial Crisis, then US Treasuries can be a good allocation. As a reminder you can buy US bonds via your LGB Investment Account, which is a multi-currency account.

Interestingly a view (which until recently was seen as an eccentric offshoot of so-called Modern Monetary Theory) is now taking hold that higher rates in the USA are actually boosting economic activity, as higher yields are being recycled into the economy, with savings being higher than mortgage debt. In the US mortgage interest is up to a certain level deductible against income tax which also protects households.

US Equities

The search for beneficiaries of the AI revolution will continue to throw up names. To what extent these will be (with the exception of specialists like Nvidia, and perhaps the data storage companies) pure AI companies and to what extent AI will simply become a productivity tool is unclear. Those of us who remember the tech boom around 2000 will recall that the snake-oil salesmen were out in force and many spurious companies were floated as supposed beneficiaries. Of course the internet did “eat the world” but it also ate many of its tech bubble babies. No doubt the same will apply to AI. Investors can gain exposure to this area directly by picking preferred shares, or via funds, or ETFs which track the performance of for example the S&P US Technology Sector (Invesco and State Street Global Advisors among others have relevant ETFs available to UK investors which are accessible via the LGB investment platform)

Closer to Home

The UK remains plunged in gloom. The consensus seems to be that neither the current nor a future Labour administration will have any fiscal room to manoeuvre, the Truss/Kwarteng interlude having shown the intolerance of the bond and currency markets for anything adventurous; that growth will remain muted for the remainder of the year and that the UK equity market will continue to see departures across the Atlantic (or to private equity). We are now hearing investment managers making comments like: “the UK looks cheap, we’re not saying we’re investing there”.

Certainly, with an economy where 22.2% of the working population is economically inactive (neither employed nor unemployed), and another 4.2% is unemployed (an eight-year high), the UK is an outlier in international terms with respect to the participation rate still being worse than before the pandemic. The Labour party has so far been extremely coy in giving any details on its proposed policies, and what has been seen seems to be more aspirational than concrete. Aspiration without detail is certainly not the monopoly of a single party and the Mansion House speech which was supposed to herald an influx of investment to smaller growth companies has yet to deliver anything concrete. The British ISA £5,000 supplement – still not in place – can hardly be said to move the dial, and HMRC still provides a tax shelter for investment in non-UK companies, which may appear eccentric. Inflation is clearly particularly embedded in the UK, even though it fell to 3.2% in March (the lowest since 2021), but core inflation seems very stubborn. Over the last month or so the consensus has shifted from three interest rate cuts this year to two. The Bank is having to trade off pressure on sterling from lower interest rates with a concomitant increase in imported inflation vs the impact of higher rates for longer on domestic economic activity.

The case against the UK can perhaps be made too easily to be true – think back to the Truss period and the confident assertions that sterling was going below $1. A continuation of strong oil pricing, and any continuation of the modest recent bounce back in iron ore prices, following the recent stronger recovery in copper pricing, has a positive effect on the FTSE given the weighting towards energy and mining companies, and the very recent tightening of sanctions on Russian imports is already having an effect on some metal prices. Low valuations ultimately attract bid activity and even if private equity firms’ “dry powder” seems to have been rather dampened, in-market deals have not stopped entirely.

AIM

AIM is the gloomiest area (this is the AIM 100 over three years):

vs the FTSE 100 over the same period:

With limited fund-raising activity the brokers themselves are facing consolidation and job losses so it is hardly surprising that they are not exuding good cheer. The AIM market fell 11% in 2023 vs a FTSE rise of almost 6%. Delistings, last a major problem around 2009 in the wake of the financial crisis, have reappeared, in some cases driven by major shareholders who see the possibility of subsequent relistings in the USA but also the potential ability to attract venture capital funding away from the spotlight of the public market – VCs dislike the requirement to mark valuations to market. The number of companies on AIM peaked at 1,694 in 2007, was 753 last year and looks set to drop below 700 this year. Changing the downtrend will require something to change and it is difficult to see what that will be. As things stand it is hard to be confident that money can be made in capital-hungry companies. On the positive side those that have turned the corner to profitability however are being rewarded by the market. And it makes sense to provide follow-on cash to development stage companies if an inflection point is really in sight.

MTNs and Gilts

On the ground all is not gloom. The alternative finance companies LGB has set up MTN programmes for are by and large seeing good activity levels, and defaults well within historical parameters, whilst they continue to benefit from the retreat of the major banks into a “computer says no” disengagement from their clients. Investors can use the MTNs to generate cash and whilst of course they are not gilt-edged or rated we continue to monitor the issuers closely, ensuring that security arrangements are indeed secure and that covenants are met.

We believe investors should see bonds as buy-and-hold investments. Profits from trading liquid bonds if and when rates drop are to an extent illusory given that the bond reinvestment opportunities will have also become less attractive. And the assumption of even a few months ago that we were returning to the super-low rates of the last 15 years does now seem to have been seriously questioned.

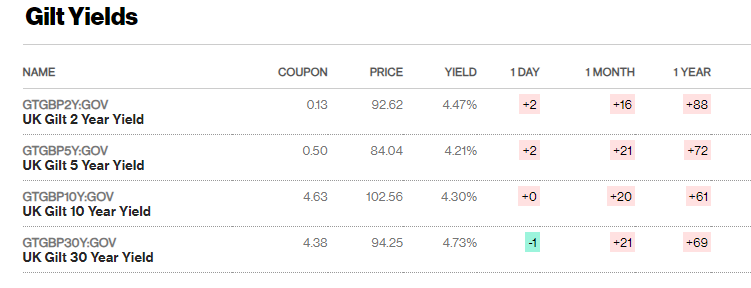

Short duration and high yields in the corporate market offer an attractive trade-off against the lower net of tax returns available in government securities (for example, the UKT 0.625% Jun-25 currently yielding 4.63% would offer a net return of 4.35% to a 45% tax payer who would only be charged on the coupon but not on the capital appreciation), as part of a tiered portfolio, and a range of high quality corporate bonds is updated weekly on LGB Deal Hub. These are the yields (pre tax) for longer maturities:

It is always worth remembering that government bonds are to a large extent bought by investors who are not paying tax on the coupons (pension funds, insurance companies managing pension funds, banks offsetting the yield against their own funding costs) and that the playing field is in that sense not even – although they can be held in ISAs and SIPPs by private investors – and gilt issues trading at a discount benefit from a CGT break on the accretion to par.

Finally, and for comparison, German Bund Euro yields are between 2.95% for two year to 2.49% for ten year. The ECB seems to have forgotten its origins as a successor to the Bundesbank and is happy to keep yields longer than a strict interpretation of their mandate might require. There seems no obvious reason to look at these markets save for those with euro liabilities to match.

Conclusion

While investors need to make their own decisions on diversification, this can be very challenging in a market environment which exhibits a mixture of optimism and caution. Maintaining a balanced portfolio of fixed income holding with varied risk profiles and duration can provide a solid starting point. Longer duration instruments such as government bonds provide a core fixed income portfolio which protects against swings in inflationary expectations. This can be complemented by shorter and higher yielding private credit, such as MTNs, to enhance yield, provide diversification and insulate the portfolio from the public markets’ volatility. The LGB investment accounts allow access to a very wide range of markets and securities and we are always happy to discuss them with you.

Sources: Bloomberg Markets, Factset, Marketwatch