Most recent update: 10/10/2025

With a number of our clients and MTN issuers in the alternative lending space, LGB has a particular perspective of the market, which has evolved significantly over the last decade. As a result, our Capital Markets teams have specialist knowledge in the area and its opportunities. On this page we offer our perspective as the alternative lending market evolves over the course of the financial year.

From Roma Finance, which is a lender specialising in property, to Rivers Finance Group, which offers asset finance, leasing and business loans, LGB has had a front row seat to the growth and success of the alternative lending sector. Here are our latest insights from the last quarter.

Property has always been a popular market for lenders, but with traditional banks being increasingly risk averse, it has become more challenging to obtain borrowings in some sectors. Speciality finance providers have therefore stepped into the space with great success, particularly in some of the non-regulated areas such as bridging finance or the buy-to-let mortgage market.

It is no secret that the UK faces multiple headwinds, but despite that, over the third quarter of 2025 the UK property market showed notable resilience. Halifax reported that house prices rose by 0.3% in August, marking the third consecutive monthly increase and pushing the average value to a new record of £299,331.

That said, year-on-year growth stood at a modest 2.2%, indicating stability despite affordability concerns. Further to that, demand appears to have remained steady, supported by improved mortgage affordability and sustained buyer interest. As such, July recorded the busiest month since 2020 for transactions according to Rightmove, although asking prices softened by 1.3% in August to an average of £368,740 as sellers competed in a well-supplied market.

The broader market seems to have held firm, with comparatively strong sales activity underscoring the property market’s underlying strength. However, uncertainty around fiscal measures, such as impending Stamp Duty reforms and other property-related tax changes in the Autumn budget, are showing signs of having dampened sentiment in certain segments, particularly at the higher end of the market.

KPMG reported in their UK Financial Services Update Q2 2025:

“Per RICS June 2025 outlook, the UK housing market showed signs of stabilisation in June, with buyer demand turning slightly positive for the first time since December 2024 and sales activity declining at a slower pace. Near-term sales expectations have improved modestly, though overall momentum remains subdued, and the 12-month outlook suggests flat sales volumes.”

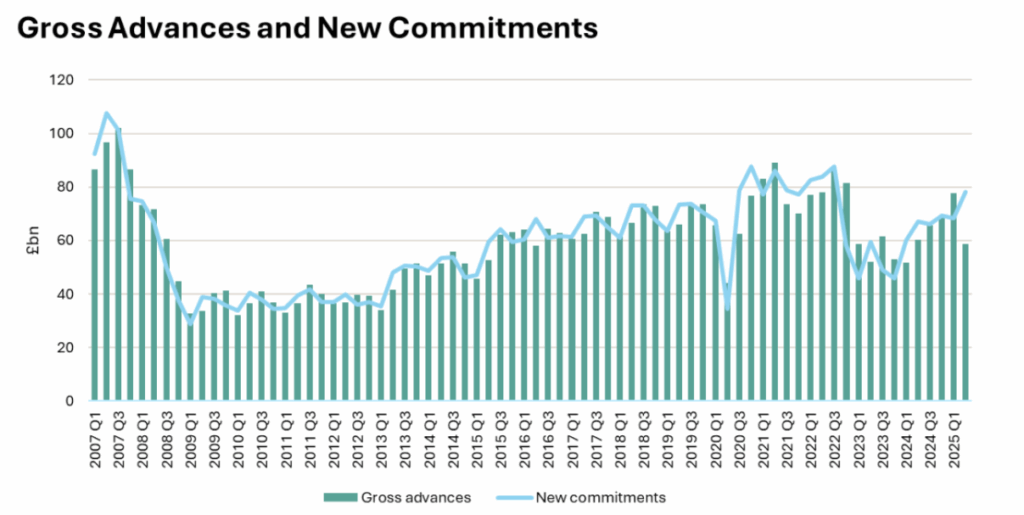

The Bank of England reports that gross mortgage advances in Q2 2025 dropped sharply to £58.8 billion, a 24.2% decline from Q1’s £77.6 billion, and about 2.4% lower year-on-year. However, new mortgage commitments (i.e. lending agreed but not yet advanced) rose to £78.2 billion, up 14.6% from Q1 and 16.8% year-on-year, indicating a healthier pipeline.

Source: Bank of England

The sharp fall in gross advances in Q2 likely reflects the pull-forward of demand into Q1 (to capture favorable stamp duty conditions before April), combined with more cautious buyer behavior in the face of rising costs. The increase in new mortgage commitments suggests that underlying demand has not evaporated, and lending activity may recover in coming quarters. For alternative lenders in the property space, this may imply a lagged rebound opportunity.

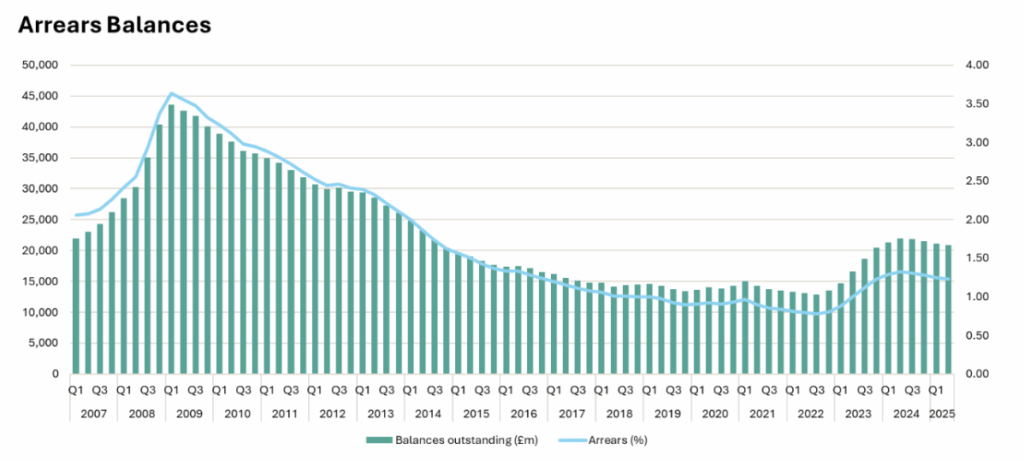

Outstanding residential mortgage balances increased modestly by 0.3% quarter-on-quarter to £1,703.6 billion, which is 2.6% higher than a year ago.

New arrears cases (as share of outstanding balances in arrears) declined to 8.8%, down 0.4pp from the previous quarter, the lowest such rate since 2022 Q1, and 2.2% lower than a year earlier. The value of outstanding mortgage balances in arrears decreased to 1.23%, 1 basis point lower than prior quarter and 9 bps lower than prior year. Of the £20.9bn of balances outstanding in arrears, the value of non-regulated mortgages (including buy-to-let and other lending where the property is not for use by the borrower, such as bridging), decreased by 2.8% from the previous quarter to £4.6bn, and was 7.5% lower than a year earlier.

Source: Bank of England

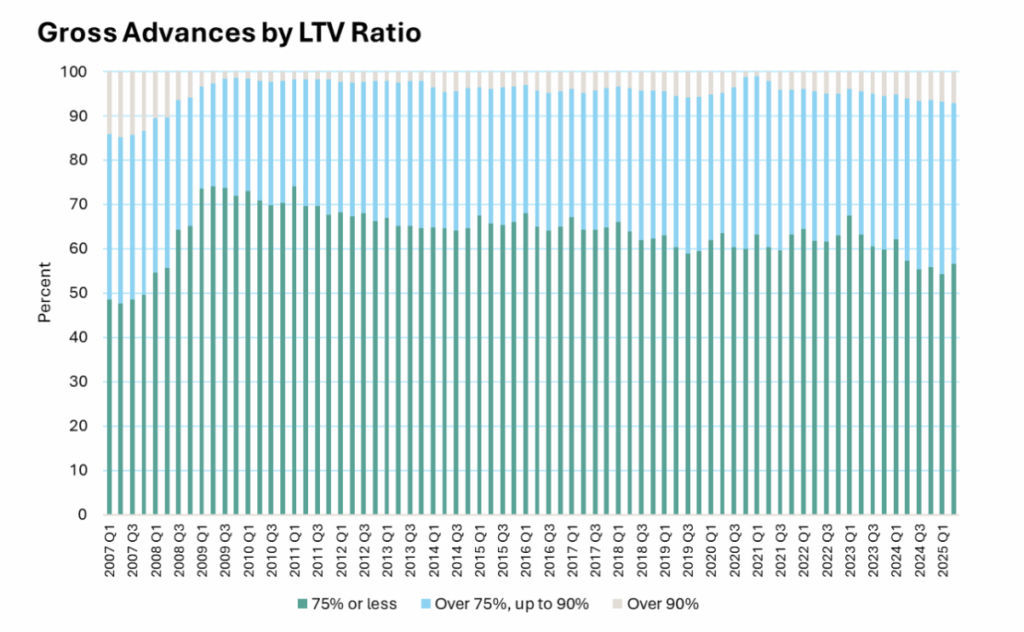

Finally, the share of mortgage advances at high LTV (above 90%) ticked up to 7.1%, a new high since 2008 Q2.

Source: Bank of Englan

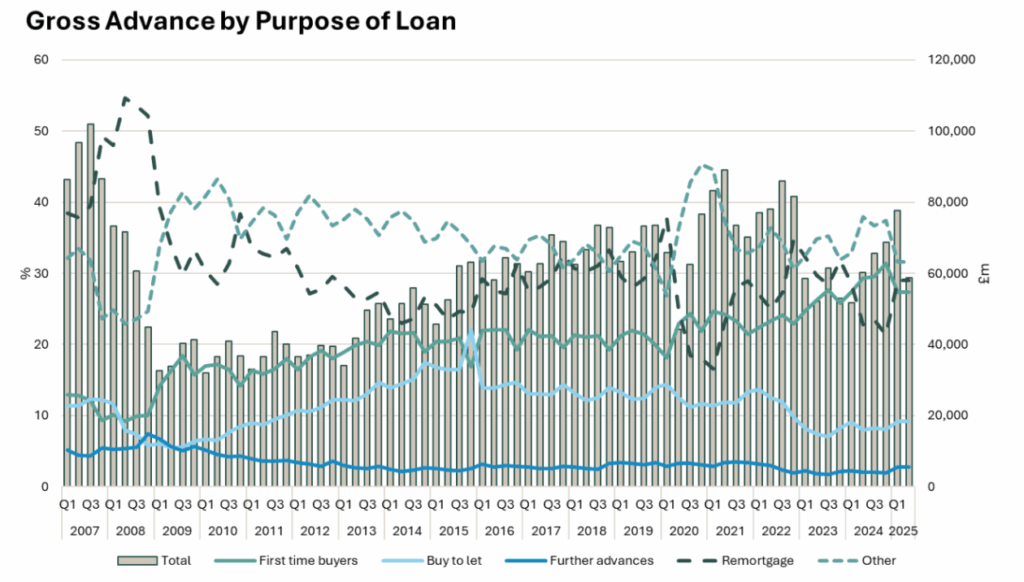

The buy-to-let sector saw notable growth in Q1 2025 according to UK Finance – 58,347 new loans were advanced nationwide, worth £10.5 billion marking a 38.6% increase by number and 46.8% by value, compared to Q1 2024. In addition, they noted that average gross rental yields nudged up to 6.94%, from 6.88% a year earlier.

This continued into Q2, with the Bank of England reporting that lending for buy-to-let purposes also gained share: in Q2 the share of gross advances for BTL rose to 9.2% (up 1.2pp from Q1), its highest level since Q1 2023.

Source: Bank of England

Interest rates on new buy-to-let loans averaged 4.99%, down 10 basis points from the previous quarter and 41 basis points lower year-on-year, and fixed-rate mortgages outstanding reached 1.44 million (+4.99% YoY), while variable-rate loans dropped notably by 15.8%, indicating landlords’ preferences toward more predictable financing.

New legislation such as the impending introduction of the Renters’ Rights Bill, alongside the removal of mortgage interest relief, and higher Stamp Duty continue to weigh on some landlords, which has led to a number leaving the sector. The Royal Institution of Chartered Surveyors (RICS) reports that the number of rental properties coming on to the UK market fell sharply for the eleventh month straight in June, according to the Financial Times. This is despite growing demand within the market.

Asset finance, leasing, and business loans (short- and medium-term), have been perhaps the strongest area of growth amongst non-bank and independent funders in the alternative finance sector. With traditional banks often lacking the product diversity, agility, and flexibility required for SME cash flow and business development requirements, alternative lenders have been stepping in to fill what is perceived to be a significant gap in the market and SME support.

With that in mind, The Finance & Leasing Association (FLA) reports that total asset finance new business in the UK rose by 3% year-on-year, marking a second consecutive month of growth.

They reported that:

Geraldine Kilkelly, Director of Research and Chief Economist at the FLA is quoted saying that despite a more subdued market than we saw in the first quarter of 2025:

“The asset finance market so far this year has reported growth in the value of new business provided to the major industry sectors – services, agriculture, and manufacturing – while holding steady in the construction sector.”

Meanwhile, The Asset Finance UK 50 (AFUK50) report (2025) notes that the top 50 asset finance firms increased their net investment in equipment leasing to £47.7 billion, an 8% rise year-on-year.

While it is clear that the economic environment has remained difficult for SMEs in 2025, with rising costs, including the rise in National Insurance playing a role in cash flow and affordability of doing business, specialist finance lenders continue to step into the breach. Brokers have reported that as much as 61% are submitting more than half of loan applications to specialist finance lenders, with the faster decision-making capabilities of non-bank lenders as well as more flexible lending options to manage cash flow and seize opportunities, being the primary drivers for decision-making.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Transaction Manager

Alexia Rottet joined LGB in October 2025 as a Transaction Manager. Prior to LGB, she gained real estate experience by participating in the valuation of a property portfolio for A2immo.ch SA as a financial analyst, as well as working at Form Structural Design as an office manager. Alexia holds an MA in Entrepreneurship and Innovation and a BA in International Relations.

Assistant Relationship Manager

Ruby joined LGB in December 2024 as an Assistant Relationship Manager for our investing clients. Prior to LGB, Ruby worked at FHIRST, a start-up where she collaborated with the co-founders on revenue growth and improving client experiences. Ruby graduated with a First-Class degree in History from Durham University.

Finance Manager

Following a degree reading Chemistry at The Queen’s College, Oxford, Antonia trained to become a chartered accountant at a London-based audit firm. She then moved into the tax sector joining EY and completing the chartered tax adviser qualification. She then gained further experience working as a finance director within industry at a family office / hedge fund.

Programme size: £20m

Establishment Date: December 2017

Number of issues: 12

Sector: Marine tracking

Focus: Maritime surveillance and management

Programme size: £25m

Establishment Date: XX 2017

Number of issues: 20

Sector: Financial services

Focus: Loans and leasing

Associate Director

Omar joined LGB in February 2026 as an Associate Director in the Capital Markets team. He brings over five years of experience from NatWest, where he worked across the Leveraged Finance Origination and Portfolio Management teams. During this time, he supported a broad range of businesses from venture-backed to large-cap companies, with a primary focus on the mid-market. His experience was sector agnostic, and the majority of the companies he worked with were sponsor-backed, giving him extensive exposure to private equity-led transactions and capital structures. Omar holds a degree in Accounting and Finance from The London School of Economics & Political Science and is a Chartered Banker.

Adviser

Charles has played an important role in developing LGB & Co.’s investment approach by encouraging a focus on investing in businesses with strong IP or know-how with recurring revenue business models that can prosper throughout economic cycles. Charles brings over 30 years’ experience of investing in privately-owned and publicly-listed small and mid-market companies. He is a director of Larpent Newton & Co. and Hygea VCT plc. Charles qualified as a Chartered Accountant at Peat Marwick, now part of KPMG.

Adviser

Lisa has worked with LGB since 2015 in supporting the on-going cultural and organisational development of the firm, providing advice on strategic people matters. Since 2006, Lisa has been running her own consultancy and executive coaching business, People Possibilities Ltd. Her work is focused on supporting clients at an organisational, team and individual level to enable high performance,improve leadership capability and effect cultural and behavioural change. Previously Lisa has held senior HR leadership positions with Schroders, ABN AMRO and HSBC. Lisa graduated from the University of Birmingham with an honours degree in International Relations & French. She is a Fellow of the Chartered Institute of Personnel and Development (CIPD) and a qualified Executive Coach.

Chairman

Simon became non-executive Chairman of the Board of LGB & Co. with a focus on growth and strategic initiatives in December 2025. Simon has extensive experience in capital markets and wealth management. He previously ran the client and investment business of Heartwood and became Chief Executive in 2008. He led its well-regarded acquisition by Handelsbanken in 2013. Simon subsequently became NED and Chair of AIM-listed WH Ireland Group PLC. He was also asked to represent the wealth management sector on the FCA Smaller Business Practitioner Panel from 2013-2016.

Capital Markets Director

Fergus advises corporate clients looking to raise debt and equity capital. He is also responsible for the execution and ongoing management of LGB’s MTN Programmes. Fergus joined LGB in 2019 having started his career at Lloyds Banking Group on the graduate training programme, before moving to the Leveraged Finance division, where he focused on transactions with mid-market corporates and PE firms. Fergus holds an MSc in Petroleum Geology from the University of Aberdeen.

Associate Director

Megan joined LGB in 2021 as a Relationship Manager. She is responsible for all day-to-day transactions with investment clients and oversees the LGB Investments Platform and Deal Hub. Prior to LGB, Megan worked at Puma Investments, a tax-efficient investment provider, in the sales and investor services team. Megan graduated from the University of Bath with a Bachelor of Science degree in Psychology, and has obtained the CISI Level 4 Diploma in Investment Advice.

Investment Director

Ivan is LGB’s Investment Director: he is responsible for developing LGB’s investment proposition in the context of the broader market and economic developments. He regularly meets individual company management teams to seek out and monitor investment opportunities. Ivan has served as a senior adviser to the Equity Division of Société Générale, and was previously Managing Director in charge of equity sales for them in London. Earlier in his career, Ivan worked at Morgan Stanley, Lazards and Schroders. He has degrees in history from Cambridge University & London University, and an MBA from Cass Business School.

Managing Director

Simone joined LGB in 2012 and is responsible for LGB & Co.’s business with institutional investors, wealth managers and sophisticated private investors. Simone’s team provides access to a range of compelling investment opportunities with a particular emphasis on structuring laddered portfolios of fixed income. In addition, the team manages portfolios of clients who have entered into advisory agreements with LGB Investments, and advises the fund managers of the Guernsey-based LGB SME Private Debt Fund. Prior to joining LGB & Co., Simone worked in the institutional fixed income department of Citigroup Global Markets. She began her career at Citigroup Private Bank in Geneva. Simone graduated from the University of Lausanne with a degree in HEC, Business Administration. She is a Chartered Member of the Chartered Institute for Securities & Investments and a Director of LGB.

CEO

Cedric was appointed CEO in July 2022 after a period of 18 months as a COO. Cedric spent 15 years working on the energy and commodities sales and trading desks for global banks (BNP Paribas, BAML and MUFG). He gained extensive international exposure, being based in London and Singapore and covering transactions in all geographic regions. Cedric graduated from Global Executive MBA at INSEAD in 2018 and started working in the capital markets space for growth-stage companies. He is also a director of LGB.

Managing Director, Capital Markets

Andrew founded LGB & Co. in 2005 and is managing the Capital Markets team. He has a particular focus on the development of strategic relationships with corporate clients and business partners. Prior to founding LGB & Co., Andrew was a Managing Director at Citigroup Global Markets, where he was responsible for its fixed-income business with private banks and retail institutions. Earlier in his career Andrew worked at Schroders in London and Tokyo. Andrew graduated from Oxford University with a degree in Modern History. He is a chartered member of the Chartered Institute for Securities & Investment.