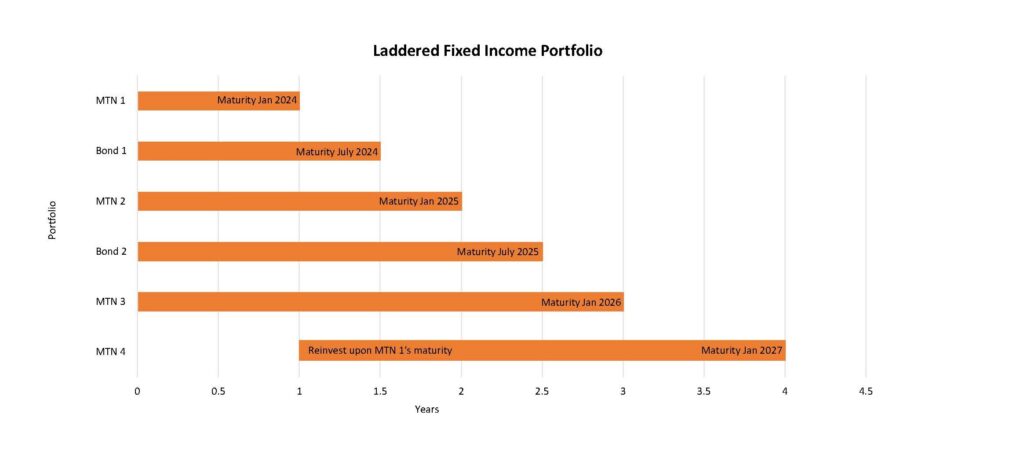

At LGB we are strong advocates of a Laddered Fixed Income Portfolio, an investment strategy consisting of an assortment of fixed income securities with staggered maturities. For our investors, this means building portfolios containing several fixed income investments with different maturity dates, ideally paying interest at different times too. It is intended that bonds are held to maturity so there is no active trading.

Laddered portfolios have a number of advantages which we believe provide very strong foundations for any investment strategy, allowing investors to consider new opportunities from a position of strength:

Managed bond funds and ETFs provide diversification benefits. They are also liquid. However they offer very different investment profiles: while a laddered portfolio receives bond redemptions at par and so amortises without reinvestment, a bond fund is a continuous investment. Investors should consider the following when choosing between direct investments or a fund:

LGB’s MTN programmes provide a regular flow of new issues, allowing investors to build laddered portfolios over time from the pool of issuers managed by LGB. There is no active secondary market in LGB’s MTN issues, although they can be sold in exceptional circumstances. In order to increase diversification further, and increase the liquidity in the portfolio, investors may seek to complement their MTN portfolios by adding longer and shorter maturity bonds. We have therefore teamed up with fixed income broker Allia City & Continental to provide our investors with a curated list of Sterling denominated bonds which are generally more liquid and can be bought in the secondary market through the LGB Investments platform.

Most bonds can be bought and held in LGB Investments ISA accounts,

LGB & Co. Limited

Tintagel House, 92 Albert Embankment

London

SE1 7TY

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Relationship Manager

Ellana joined LGB in March 2024 as a Relationship Manager for our investing clients. Prior to LGB, Ellana worked at Bellecapital, handling client relationships and supporting the portfolio management team. Ellana graduated with a First-Class in Mathematics from Cardiff University and has a Level 4 Investment Advice Diploma.

Adviser

Simon became an Advisor to the Board of LGB & Co. with a focus on business strategy and initiatives in March 2024. Simon has extensive experience debt capital markets and wealth management. He previously ran the client and then the investment business of Heartwood and became Chief Executive in 2008. He led its well-regarded acquisition by Handelsbanken in 2013. Simon subsequently became NED and Chair of AIM-listed WH Ireland Group PLC. He was also asked to represent the wealth management sector on the FCA Smaller Business Practitioner Panel from 2013-2016.

Finance Manager

Following a degree reading Chemistry at The Queen’s College, Oxford, Antonia trained to become a chartered accountant at a London-based audit firm. She then moved into the tax sector joining EY and completing the chartered tax adviser qualification. She then gained further experience working as a finance director within industry at a family office / hedge fund.

Founder and Chairman

Andrew founded LGB & Co. in 2005 and is the Chairman of the company. He has a particular focus on the development of strategic relationships with corporate clients and business partners. Prior to founding LGB & Co., Andrew was a Managing Director at Citigroup Global Markets, where he was responsible for its fixed-income business with private banks and retail institutions. Earlier in his career Andrew worked at Schroders in London and Tokyo. Andrew graduated from Oxford University with a degree in Modern History. He is a chartered member of the Chartered Institute for Securities & Investment.

Capital Markets Director

Fergus advises corporate clients looking to raise debt and equity capital. He is also responsible for the execution and ongoing management of LGB’s MTN Programmes. Fergus joined LGB in 2019 having started his career at Lloyds Banking Group on the graduate training programme, before moving to the Leveraged Finance division, where he focused on transactions with mid-market corporates and PE firms. Fergus holds an MSc in Petroleum Geology from the University of Aberdeen.

Adviser

Lisa has worked with LGB since 2015 in supporting the on-going cultural and organisational development of the firm, providing advice on strategic people matters. Since 2006, Lisa has been running her own consultancy and executive coaching business, People Possibilities Ltd. Her work is focused on supporting clients at an organisational, team and individual level to enable high performance,improve leadership capability and effect cultural and behavioural change. Previously Lisa has held senior HR leadership positions with Schroders, ABN AMRO and HSBC. Lisa graduated from the University of Birmingham with an honours degree in International Relations & French. She is a Fellow of the Chartered Institute of Personnel and Development (CIPD) and a qualified Executive Coach.

Adviser

Charles has played an important role in developing LGB & Co.’s investment approach by encouraging a focus on investing in businesses with strong IP or know-how with recurring revenue business models that can prosper throughout economic cycles. Charles brings over 30 years’ experience of investing in privately-owned and publicly-listed small and mid-market companies. He is a director of Larpent Newton & Co. and Hygea VCT plc. Charles qualified as a Chartered Accountant at Peat Marwick, now part of KPMG.

Programme size: £25m

Establishment Date: XX 2017

Number of issues: 20

Sector: Financial services

Focus: Loans and leasing

Programme size: £20m

Establishment Date: December 2017

Number of issues: 12

Sector: Marine tracking

Focus: Maritime surveillance and management

Associate

Ben joined LGB in October 2022 as an associate after spending three years as a credit analyst at 9fin, where he produced research on corporates in the European & US High Yield and distressed debt markets.Ben holds an MSc in Investment Management from Bayes Business School (formerly Cass) and is a CFA charter holder.

CEO

Cedric was appointed CEO in July 2022 after a period of 18 months as a COO. Cedric spent 15 years working on the energy and commodities sales and trading desks for global banks (BNP Paribas, BAML and MUFG). He gained extensive international exposure, being based in London and Singapore and covering transactions in all geographic regions. Cedric graduated from Global Executive MBA at INSEAD in 2018 and started working in the capital markets space for growth-stage companies. He is also a director of LGB.

Relationship Manager

Megan joined LGB in January 2021 as a Relationship Manager. She is responsible for all day-to-day transactions with investment clients and oversees the LGB Investments Platform and Deal Hub. Prior to LGB, Megan worked at Puma Investments, a tax-efficient investment provider, in the sales and investor services team. Megan graduated from the University of Bath with a Bachelor of Science degree in Psychology. Megan obtained the CISI Level 4 Diploma in Investment Advice in October 2021.

Investment Director

Ivan is LGB’s Investment Director: he is responsible for developing LGB’s investment proposition in the context of the broader market and economic developments. He regularly meets individual company management teams to seek out and monitor investment opportunities. Ivan has served as a senior adviser to the Equity Division of Société Générale, and was previously Managing Director in charge of equity sales for them in London. Earlier in his career, Ivan worked at Morgan Stanley, Lazards and Schroders. He has degrees in history from Cambridge University & London University, and an MBA from Cass Business School.

Managing Director

Simone is responsible for LGB & Co.’s business with investing clients, who include institutional investors, wealth managers and sophisticated private investors. Simone’s team provides access to a range of compelling investment opportunities with a particular emphasis on proprietary medium term note and equity transactions. Simone manages the portfolios of clients who have entered into advisory or discretionary investment agreements with LGB Investments, and advises the fund managers of the Guernsey-based LGB SME Fund. Prior to joining LGB & Co., Simone worked in the institutional fixed income department of Citigroup Global Markets. She began her career at Citigroup Private Bank in Geneva. Simone graduated from the University of Lausanne with a degree in HEC, Business Administration. She is a Chartered Member of the Chartered Institute for Securities & Investments.