Life Sciences – a few signs of life

Ivan Sedgwick – November 2022

We last looked at the group of companies we follow in life sciences in June [Is there life in Life Sciences?], at which point almost every stock in the group we cover – bar Arecor- was down significantly from the middle of 2021, when interest in both life sciences and tech generally peaked. The picture since then is not one of stability in individual shares, but of more-or-less stability in the group as a whole. There have been some sharp variations. Diurnal was taken over at 147% of its June level, and Maxcyte, which at that point was trading at only a modest premium to the cash on its balance sheet has doubled- or at least it has doubled in sterling. There is no clear pattern. Renalytix, the other Nasdaq quoted stock in the group is down another 63% and has been worse, and Yourgene is down by the same amount. It is not the case that raising cash and extending the runway has helped: Angle is the next worst perfomer, and Arecor and C4XD are also down. Good news has also not necessarily been a catalyst for strong performance as we saw Scancell up 48% on news, but Angle has fallen despite the long-awaited FDA approval.

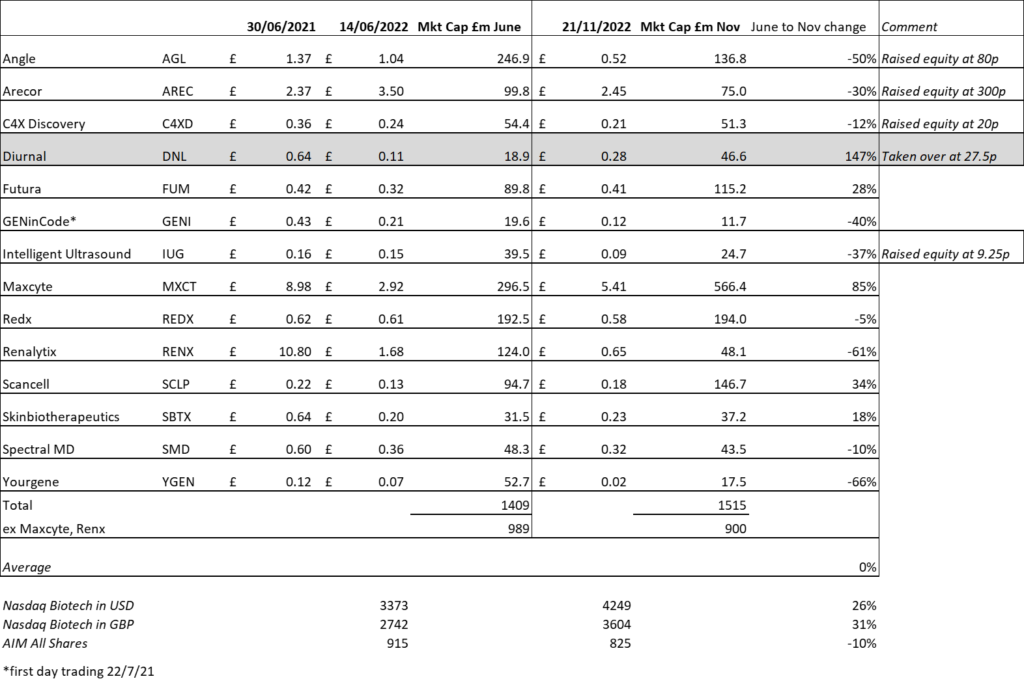

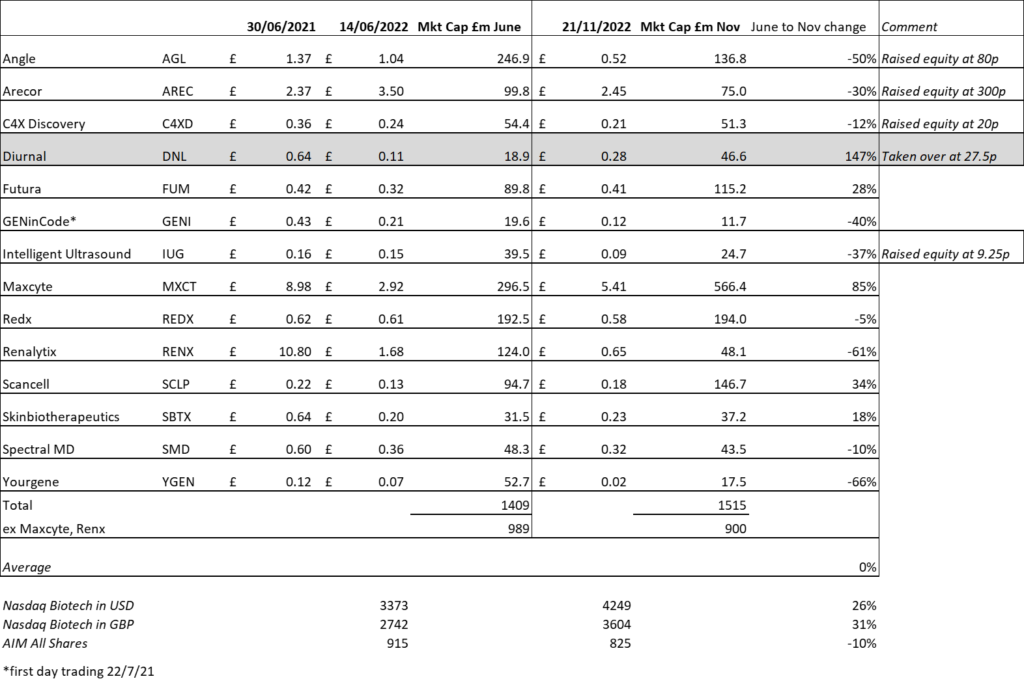

Since June the Nasdaq Biotech index, which peaked out last summer, has rallied by over 20%- and more like 30% in sterling. AIM has stayed out of favour. From early June to early this month it was down 10%. The following table shows changes from the date of our last comment on the sector till a few days ago:

It is definitely the case that institutions that invest in AIM have not been seeing inflows into their AIM funds, and there has been a massive hangover amongst retail investors. What new money there is has been directed into VCT funds, which tend to distort the market (and indeed we are seeing examples of the EIS/VCT element of fund raises being oversubscribed, as with the Intelligent Ultrasound raise announced on 11th November). But of course these don’t support the aftermarket. And indeed, the Intelligent Ultrasound price has not shifted, despite the offering raising a little over the higher end of the amount targeted, and despite the CEO stating that this would be sufficient to see them through to profitability, which in more normal times ought together to have moved the price.

The Diurnal takeover was interesting. The acquirer (Neurocrine) is a rather larger US company. It moved on Diurnal when the share price was languishing after a hiccup in product rollout, the departure of the CEO and an admitted need to raise money in a tough market. They paid a significant premium but arguably still got a bargain, particularly when taking into account the favourable foreign exchange rate. We have so far not seen a great deal of corporate or indeed public-to-private private equity deals in this space, but it would be logical for them to come. Andy Craig who is currently IPO’ing a Conviction Life Sciences Fund (click here for more information on this) is arguing strongly that given the prices being paid for assets in the USA, the strong science and low valuations in the UK will start attracting more outside buyers, whether corporate or private equity firms such as Redmile, who have significant positions in Redx and Scancell.

All the companies in this group still have a strong investment case. We particularly wish to draw investors’ attention to two: Arecor and Yourgene:

Arecor Therapeutics plc (AREC.L)

Arecor has fallen about 30% since mid June- for no obvious reason. The company’s Arestat formulation platform seems to have found a sweet spot in helping to develop improved insulin formulations for diabetes, one of the world’s great expanding problems, and they made an interesting add-on acquisition since the summer of Tetris Pharma bringing them a glucagon auto-injector pen to deal with hypoglycaemia which they are now starting to roll out. They are initiating a second phase 1 study for their AT278 ultra-rapid insulin this year, this time aimed at Type ll diabetes, and reported good phase 1 date for a pump application of AT247. They are funded through key inflection points having raised £6m in August to support the Tetris raise. They have partnerships with a number of large pharma companies including Lilly. Arestat facilitates the creation of biosimilars, the equivalent of generic drugs for biologics, but more expensive to develop and much more commercially valuable. Their AT220 biosimilar, being developed with a global top five pharma company, could be the first to market. They announced another biosimilar collaboration on 10th November (albeit frustratingly NDAs have prevented any useful data on it coming out, albeit it was clearly material enough to merit an RNS). Trinity Delta have a 574p/ share valuation, updated for the Tetris acquisition and raise, but before the most recent trial data and new collaboration was released, and noted in September that they were “aware of a raft of potential news flow, notably clinical trial related, over the coming months”. Which we are indeed starting to see.

Yourgene Health plc (YGEN.L)

Yourgene has fallen over 60% since June. There are some reasons but the valuation now appears compelling- providing they can avoid raising cash. Like many companies that expanded to meet demand for Covid testing- and unusually, in their case, for Covid sequencing- they suffered from a hangover when it abruptly ceased. However they had taken advantage of the boom to buy new equipment and to consolidate all their operations in one building in the Manchester Science Park. The non-invasive prenatal testing (NIPT) business was hugely slowed by Covid but they have now licensed their test to Ambry and EKF in the USA, and in return will be selling other Ambry tests in Europe. NIPT grew at 18% yoy in H1, and overall core (non Covid) revenues 14%. Their Ranger sampling technology offers CROs and pharma companies quick and accurate testing. However, their EBITDA has dropped into negative territory for the current year (to March 2023) albeit it is anticipated to return to positive territory the next year. The company is trading off margins against growth and is running a modest net debt position. Clearly from the share price performance the market (in this case almost entirely retail shareholders) anticipates they will need to raise more equity, though management believe they can avoid this. The current valuation- EV- sales of about 1.5x, and nearer 1x if lease liabilities under IFRS for their new HQ are excluded, as they would be under US GAAP, is extremely modest. They would be a bite-sized morsel for Ambry (part of Konica Minolta) and affordable for EKF (which trades on about 3x EV/Sales but is profitable). And they have various possible ways to raise cash to reinvest in the core business, including potentially selling the Taiwanese business (now breakeven) or perhaps licensing Ranger. However, any investment in Yourgene should be done on the basis that they might well be back for further funding.

We continue to follow these companies closely and would be more than happy to discuss any of the above in more detail.